How To Register An Out Of State Business In Texas

Does an out of state llp have to register with the secretary of state before it transacts business in texas.

How to register an out of state business in texas. Decide on a business structure. The registered agent must be located in the state where you register. If your out of state business is exempt you may choose to file a notification statement with the secretary of state. If your business is an llc corporation partnership or nonprofit corporation you ll need a registered agent in your state before you file. Those businesses operating within the state of texas are additionally required to register for more specific identification numbers licenses or permits for different tax purposes.

Out of state financial institution application for registration application by an out of state financial institution to transact business in texas. 05 11 of pages 6 word pdf 311. A registered agent receives official papers and legal documents on behalf of your company. All exemptions under chapter 112 of the business commerce code cease at the end of the disaster response period. Please see form 3901 pdf for out of state businesses and form 3902 pdf for affiliates of in state businesses.

The secretary of state offers general information relating to the formation of certain texas businesses registration of certain foreign businesses and other helpful business start up information. See form 312 word pdf. A foreign business trust has been required to register with the secretary of state if it is transacting business in texas since january 1 2006 the effective date of the boc. Any entity whether a corporation limited liability company limited company limited liability partnership or a limited partnership registered or filed with the secretary of state of texas has its information stored in the section for future reference. Once you ve decided on your business structure you will need to register the business for tax purposes.

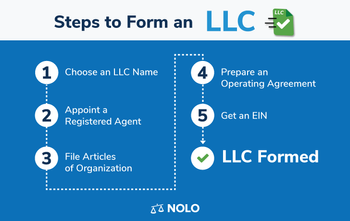

Obtain your federal employer identification number. If you decide to incorporate register with the secretary of state s office sos. The texas corporations section is the record book of every business entity and corporations that are or were incorporated in the state. Examples of these include income tax withholding sellers permits for sales and use tax and unemployment insurance tax. Determine the appropriate legal structure of the business and file the business name with the state or county.

The first step in determining how to register your business with the state for tax purposes is to decide on the appropriate business structure. Some common structures include a sole proprietorship a partnership or a corporation. In general sole proprietorships and partnerships need to register with the county clerk s office.