How To Register A Non Profit Organization In Ohio

Consent from the prior registrant to register the name.

How to register a non profit organization in ohio. Ohio requires charitable organizations located in ohio and groups that ask ohioans for contributions to register and file annual reports. As of september 17 2020 paper check payments are no longer accepted for filing fees or late fees. Submit copies of your articles of incorporation irs exemption letter bylaws form cfr 1 and a charitable organization registration to the office of the attorney general charitable law section. If your nonprofit solicits charitable contributions in ohio you ll likely need to register as an ohio charity with the office of the attorney general and renew each year. Incorporating a nonprofit involves the filing of a formation document usually referred to as articles of incorporation unless otherwise indicated below.

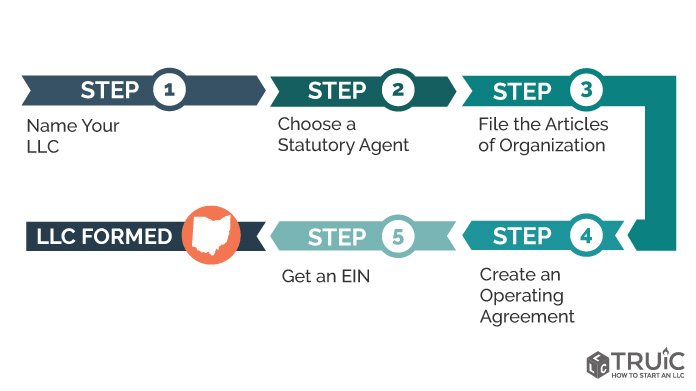

Register with the ohio attorney general s office if entity is a charitable organization. Charities operating in the state of ohio are required to file a one time registration and then submit annual reports with the ohio attorney general s office. These are the steps to take to incorporate your nonprofit. There are no additional fees charged for e check or credit card payments. The irs s exempt organizations selection check can be used to verify if an organization has a valid 501 c 3 or other tax exempt designation.

Apply for a nonprofit postal permit. The filing fee is 99 00. In addition to checking whether an organization is current with its registration requirements with the ohio attorney general s office other good sources of information include. Ohio secretary of state p o. These filings are public and contribute to accountability and transparency within the charitable sector.

Go to ohioattorneygeneral gov for more information. Charities must use our online system to register and file their annual reports. Initial articles of incorporation filing fee. All ohio nonprofits that will solicit contributions must register with the ohio attorney general within 6 months of creation. Some organizations are exempt such as churches and parent teacher associations but most nonprofit charities should expect to register.

Establishing a nonprofit corporation registering a nonprofit corporation with the secretary of state to be legally organized a nonprofit corporation must file initial articles of incorporation articles form 532b with the ohio secretary of state s office. Box 670 columbus oh 43216 the filing fee is 125 the expedited processing is 100. Initial filing requirements to become an ohio nonprofit how to incorporate in ohio state. In ohio this document is filed with the ohio secretary of state s office. Choose a business name make sure to check the state by state information on the various laws that apply to naming a nonprofit in your state.