How To Apply For Medicare Levy Exemption

Using some very simple numbers.

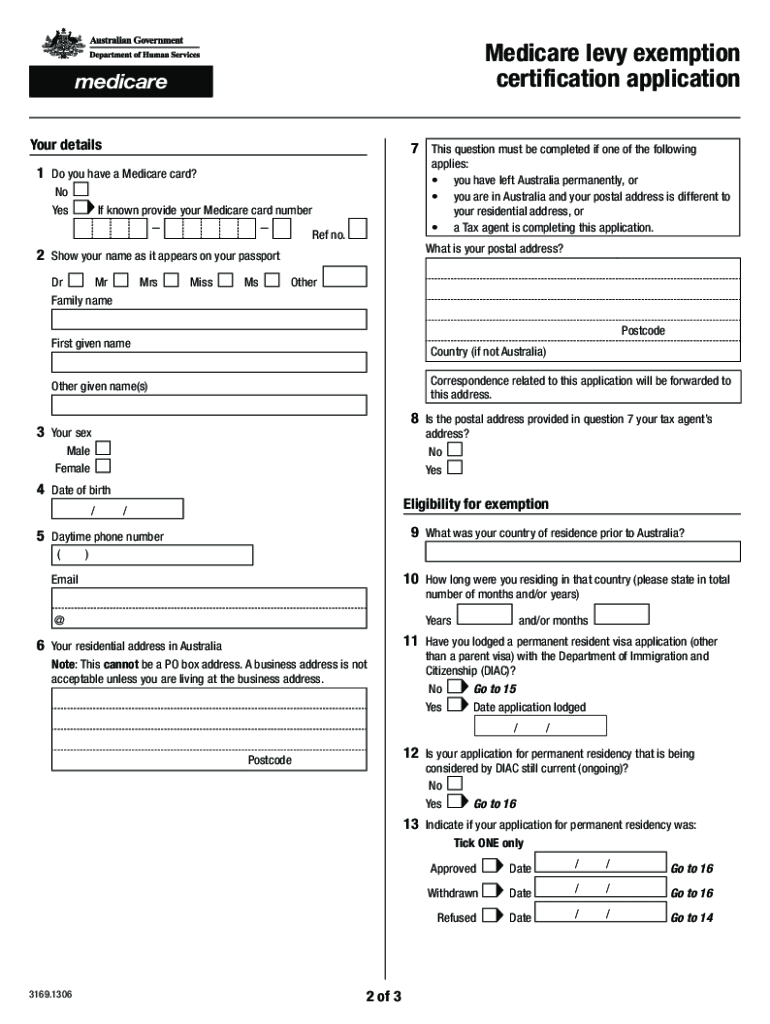

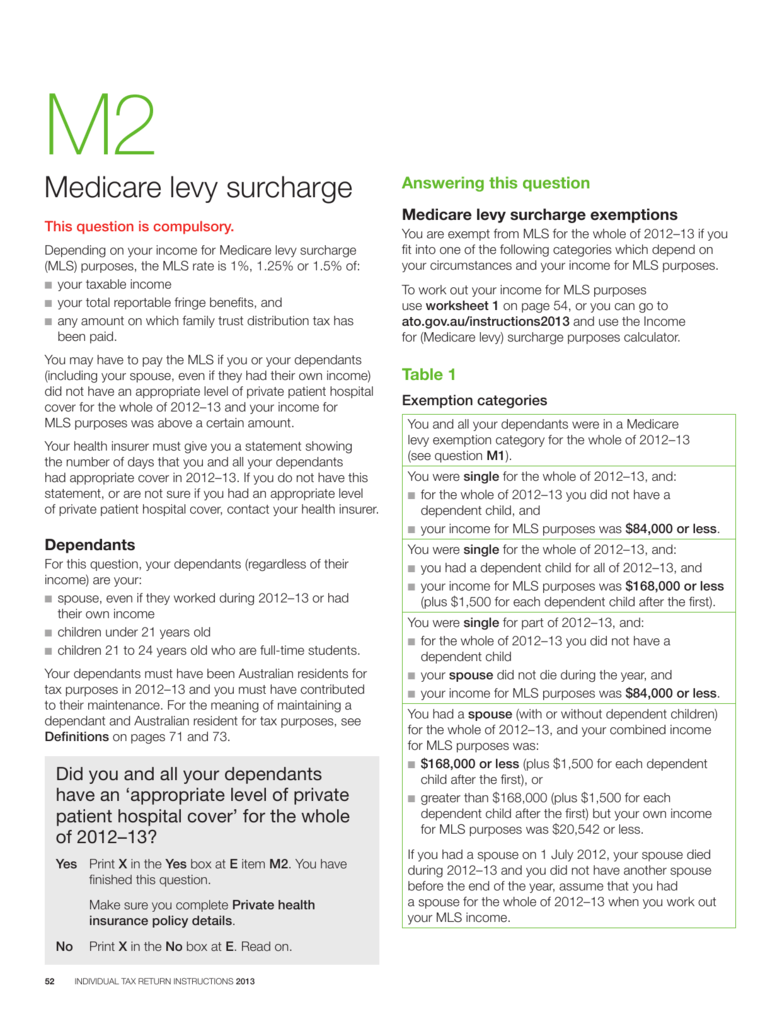

How to apply for medicare levy exemption. The medicare levy helps fund some of the costs of australia s public health system known as medicare. You do this as part of your tax return. 1 of 4 ms015 191 2 application for a medicare entitlement statement when to use this form use this form to ask for a medicare entitlement statement mes if you are not eligible for medicare and want to claim the medicare levy exemption. If you earn more than 28 501 in the most recent tax year you will pay the medicare levy at a simple 2 of your taxable income. If you were not eligible for medicare you might be exempt from paying the medicare levy in your tax return.

You need a medicare entitlement statement. Application for a medicare entitlement statement form ms015 use this form if you re not eligible for medicare and are applying for an exemption from the medicare levy. Ato community is here to help make tax and super easier. An employee earning 50 000 in the last tax year pays 1 000. Show the number of dependent children and students.

A medicare levy exemption is based on specific categories. A mes tells you the period during a financial. If you weren t eligible for medicare for all or part of the year you can apply for an exemption. The medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. Ask questions share your knowledge and discuss your experiences with us and our community.

If you qualify for an exemption you claim the exemption through your tax return. If you were not eligible for medicare you might be exempt from paying the medicare levy in your tax return. You may get a reduction or exemption from paying the medicare levy depending on your and your spouse s circumstances. At the medicare levy reduction heading. At personalise return you don t need to make a selection to show medicare levy reduction or exemption as it s always displayed at prepare return.

A mes tells you the period during a financial year that you were not eligible for medicare. At prepare return select add edit at the medicare and private health insurance details banner. A part time or casual employee who earned 20 000 pays zero medicare levy. If you have any dependants you need to consider their circumstances as well as your own to determine if you qualify for an exemption. Use this form to ask for a medicare entitlement statement mes if you are not eligible for medicare and want to claim the medicare levy exemption.